Water & Wastewater Treatment Equipment Industry Data Book - Primary, Secondary and Tertiary Water & Wastewater Treatment Equipment Market Size, Share, Trends Analysis, and Segment Forecasts, 2023 - 2030

The global Water & Wastewater Treatment Equipment Industry was valued at USD 63.4 billion in 2022 and is anticipated to increase at a significant CAGR from 2023 to 2030.

Grand View Research’s water & wastewater treatment equipment industry database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Primary Water & Wastewater Treatment Equipment Market Insights

The global primary water and wastewater treatment equipment market size was estimated at USD 12.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. Rising demand for clean water has resulted in augmenting the number of water and sludge treatment plants globally, thereby driving the growth of the market. Primary water & wastewater treatment involves the separation of floating materials and heavy solids from effluent. The slurry is passed through several tanks and filters that separate water from contaminants. Low operating costs and high market visibility of the process are expected to play a crucial role in increasing the application scope of primary treatment over the forecast period.

Primary wastewater treatment includes the removal of large solids from sewage using physical techniques such as sedimentation, skimming, and screening. During the primary treatment process, around 65% of the grease & oil, over 50% to 70% of the total suspended solids (TSS), and 25% to 35% of the biochemical oxygen demand (BOD) are removed.

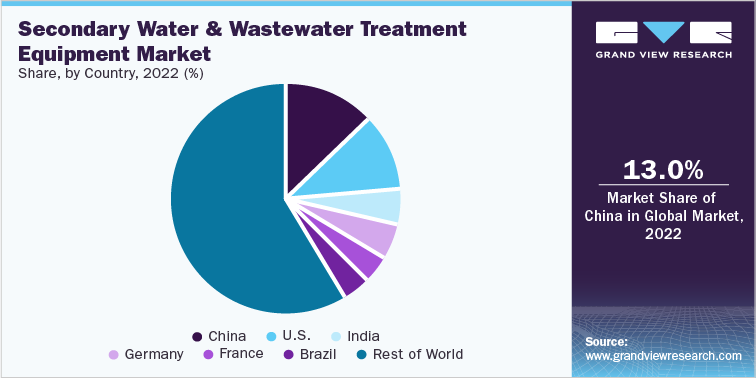

Secondary Water & Wastewater Treatment Equipment Market Insights

The global secondary water and wastewater treatment equipment market size was estimated at USD 23.3 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 4.3% from 2023 to 2030. Growing demand for wastewater treatment plants coupled with stringent regulations concerning secondary water & wastewater treatment equipment is anticipated to drive the market growth. Secondary treatment is used mainly to remove soluble organic matter and chemicals through the usage of trickling filters, bio-towers, rotating biological contactors, and activated sludge systems. Furthermore, technological incorporation in terms of the development of new methods including moving bed biofilm reactors (MBBR) and integrated fixed film activated sludge (IFAS) for secondary treatment methods is expected to have a strong impact on the market. These aforementioned factors will drive the demand for secondary water & wastewater treatment equipment in the coming years.

A growing population, coupled with rapid urbanization, is anticipated to drive the demand for critical infrastructure, including wastewater treatment plants. In addition, new housing developments, most notably in developing countries, are likely to exert pressure on the existing wastewater treatment infrastructure, thereby driving the need for either capacity expansion of existing plants or the construction of new wastewater treatment plants.

Order your copy of the Free Sample of “Water & Wastewater Treatment Equipment Industry Data Book - Primary, Secondary and Tertiary Water & Wastewater Treatment Equipment Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Tertiary Water & Wastewater Treatment Equipment Market Insights

The global tertiary water & wastewater treatment equipment market size was estimated at USD 27.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The stringent government regulations have primarily boosted various tertiary water & wastewater treatment activities worldwide, thereby augmenting the demand for water and wastewater treatment equipment over the forecast period. In addition, increasing government initiatives to provide safe drinking water are anticipated to have a positive impact on the growth of the market over the forecast period.

The industrial sector is a major water user. Water is used in production processes, cooling purposes, cleaning/washing, and many other applications. In addition, the industrial sector is a major water polluter and numerous industries do not treat wastewater before disposing into the environment, which leads to a lack of clean water. Therefore, many governments have made strict laws for wastewater emissions into the environment. These factors are expected to drive the water and wastewater treatment equipment industry’s growth over the forecast period.

Go through the table of content of Water & Wastewater Treatment Equipment Industry Data Book to get a better understanding of the Coverage & Scope of the study

Water & Wastewater Treatment Equipment Industry Data Book Competitive Landscape

The manufacturers of water & wastewater treatment equipment adopt several strategies, including merger & acquisition, new product developments, partnership & joint ventures, distributor agreements, and geographical expansions, to enhance their market presence and cater to the ever-changing consumer requirements.

Key players operating in the Water & Wastewater Treatment Equipment Industry are:

- Calgon Carbon Corporation

- Toshiba Corporation

- Veolia Group

- Ecologix Environmental Systems, LLC

- Evonik Industries AG

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter